does ca have estate tax

The State Controllers Office Tax Administration Section administers the Estate Tax Inheritance Tax and Gift Tax programs for the State of California. But local assessments can be a.

Named In The Will What To Know About Canadian Inheritance Tax Laws 2022 Turbotax Canada Tips

There are no state-level estate taxes.

. It does not matter how large or small your estate is what types of assets you control how many heirs you have or what estate planning. California does not have a separate capital gains tax rate unlike some jurisdictions. California previously did have what was called an inheritance tax which acted similar to an estate tax the primary difference.

We have offices throughout California and we offer in-person phone and Zoom appointments. California does have a state sales tax which can range from approximately 7 to 10. The base tax rate is one of the highest in the country.

Homeowners age 62 or older can postpone payment of property taxes. California Legislators Repealed the State Inheritance Tax in 1981. As long as the estate in question does not have assets exceeding 1170 million for 2021 or 1206 million in 2022 you are most likely not on the hook for federal estate or.

California does not have an inheritance tax estate tax or gift tax. A California Estate Tax Return Form ET-1 is required to be filed with the State Controllers Office whenever a federal estate tax return Form-706 is filed with the Internal Revenue Service IRS. The Economic Growth and Tax Relief.

The state of California does not impose an inheritance tax. People who are starting the estate planning process often wonder about the potential estate or inheritance tax implications. California does not impose an estate tax but the federal government does.

And married couples or Registered Domestic Partners can save up to 500000 using the capital. Estate taxAs the grantor or bequeather paying estate taxes is your responsibility not the heirs or beneficiaries. For most individuals in California this is no.

We also offer a robust overall tax-planning service for high net-worth families. However California residents are subject to federal laws governing gifts during their lives and their estates after they die. After someone passes away the only tax imposed on his or her California state will be a federal estate tax.

You must have an annual income of less than 35500 and at least 40 equity in your home.

Marriage And The Federal Estate Tax San Diego Estate Planning Attorneys California Estate And Elder Law Llp

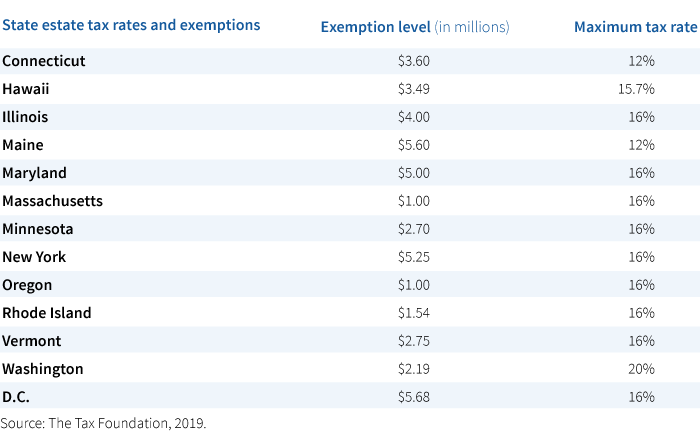

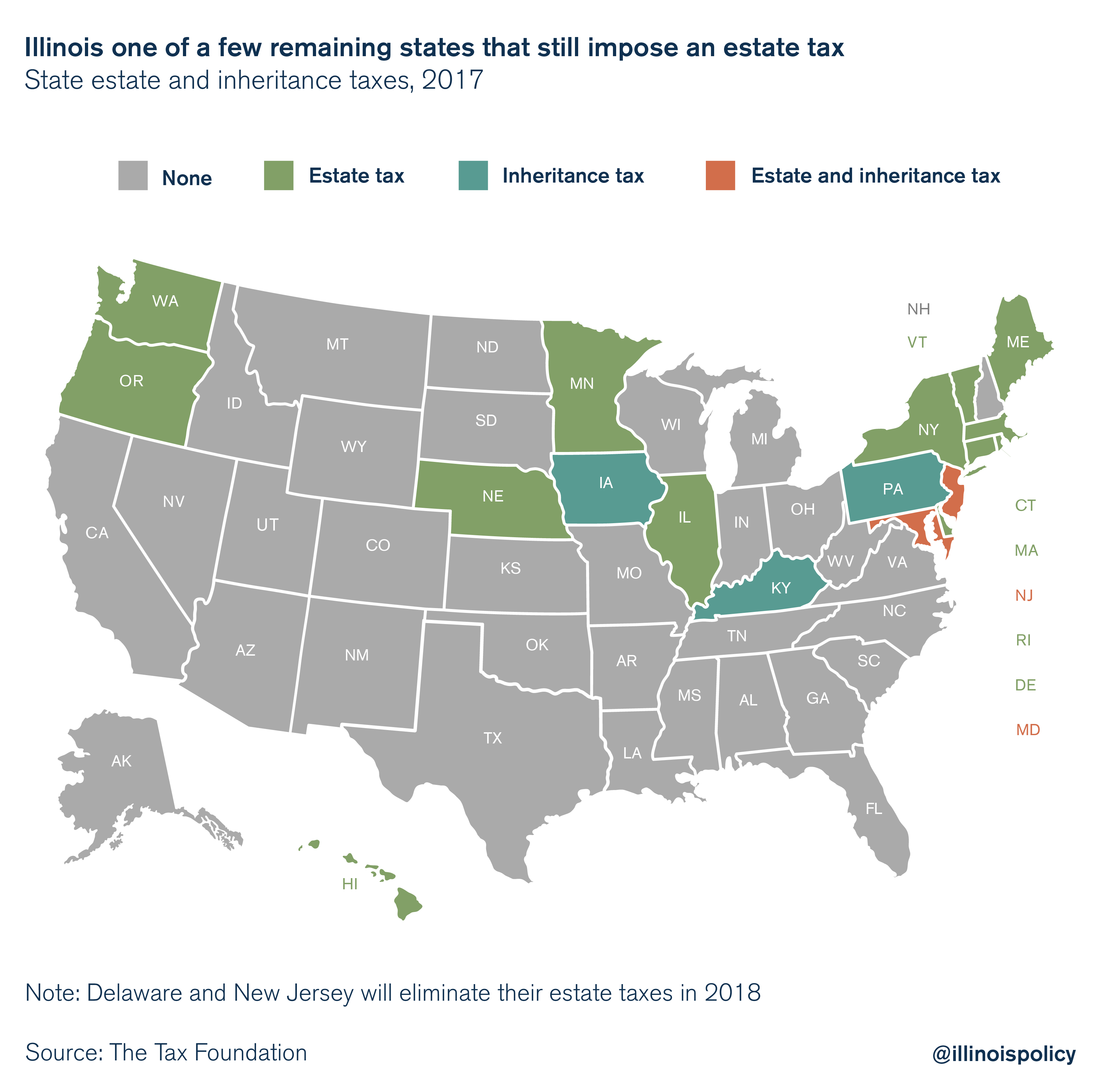

Does Your State Have An Estate Or Inheritance Tax

State Estate And Inheritance Taxes Itep

California Estate Gun Corporate Taxes Die At Legislature The Sacramento Bee

California Estate And Gift Tax Planning Forms And Practice Manual

Does New York Have An Inheritance Tax Or An Estate Tax

Will My Heirs Be Forced To Pay An Inheritance Tax In California

States With No Estate Tax Or Inheritance Tax Plan Where You Die

New Irs Data Reiterates Shortcomings Of The Estate Tax Tax Foundation

Coast Litigation Current Estate Taxes And How They Can Change With This Election

California Estate Tax Is Inheritance Taxable Income

Is Inheritance Taxable In California California Trust Estate Probate Litigation

California Estate Planning Tax Cunninghamlegal

Fewer Estates Taxed Under Tax Reform But State Taxes Still A Concern Putnam Investments

Inheritance Tax On House California How Much To Pay And How To Avoid It

As Other States Repeal Illinois Death Tax Remains

California Proposes A State Gift And Estate Tax Beginning 2021 Wealth Management

Publications Research Amp Commentary New California Estate Tax Would Be Huge Burden On An Already Overtaxed State Heartland Institute